The Big Question - Why Was the Loan Denied?

The loan was already pre-approved. So why did underwriting deny the loan?

Express Training Gives You the Answers

Learn the secrets that were kept from you to keep you from winning your independence.

Gain the Knowledge to Prevent Future Denials

Gain the understanding behind the reasons for the denial and learn how to resolve them..

You Win the Big Reward

After months of hard work, you get to keep your hard-earned, large commission check.

EXPRESS TRAINING

One-on-One Coaching

Live Session & Zoom Session

$925

Session Dates & Details

- Session Dates: Monday or Tuesday

- Session Hours: 1:30PM - 5:30PM

- Live Class: Join us for an immersive, in-person class at our SoCal training center: 22792 Center Drive, Ste. 115 Lake Forest, CA

- Zoom Session: Experience personalized one-on-one training with an experienced, licensed loan broker.

- Questions? Email us at support@mloprotraining.com

- Click HERE to view our Refund & Cancellation Policy

- Click HERE to view our Frequently Asked Questions (FAQ)

Session Requirements & Conditions

To ensure you receive the most effective one-on-one coaching and tailored solutions during your session, we require that you submit specific loan documentation in advance. This allows our trainer to thoroughly review your file, identify key issues, and prepare actionable strategies before the session begins.

Required Action:

Upon completing your registration, please email the following documents to anh@mlotraining.com no later than one (1) day before your scheduled session.

Failure to provide these documents on time may delay or impact the quality of your training.

Documents Required for Review:

1. Complete Set of Signed and Dated Uniform Residential Loan Application (URLA) Forms

-

Include all pages of the loan application as originally submitted to underwriting.

-

Ensure the forms are signed and dated by the borrower(s).

-

Provide any updated versions if changes were made during processing.

2. Most Current Underwriting Conditions Report

-

Include the latest list of conditions issued by the underwriter.

-

Clearly identify any “Reasons for Denial” or “Suspense” notes.

-

Attach any supporting documentation referenced in the conditions (if available).

3. Additional Supporting Documentation (If Applicable)

-

Title report, appraisal report, or inspection findings if they relate to the denial.

-

Recent communications from underwriting or lender that highlight specific issues.

-

Any other relevant documents that may assist in evaluating the loan’s current status.

Take Action Now!

- Turn Your Investment to Save Your Big Commission Check

- Get Immediate Rescue to Prevent Loan Fallout

- Secure More Loan Approvals & More Future Referrals

- Don’t Wait Until It’s Too Late - Reserve Your Session Now!

RESERVE YOUR SEAT

Refund & Cancellation Policy

By completing your registration, you acknowledge and agree that all enrollments are final. While we do not offer refunds, we understand that schedules can change. If you cancel within the permitted notice period, we’ll issue you a credit to attend a future session of the same course type purchased. Credits cannot be applied to different courses and must be used within 12 months. No-shows forfeit all tuition/enrollment fees.

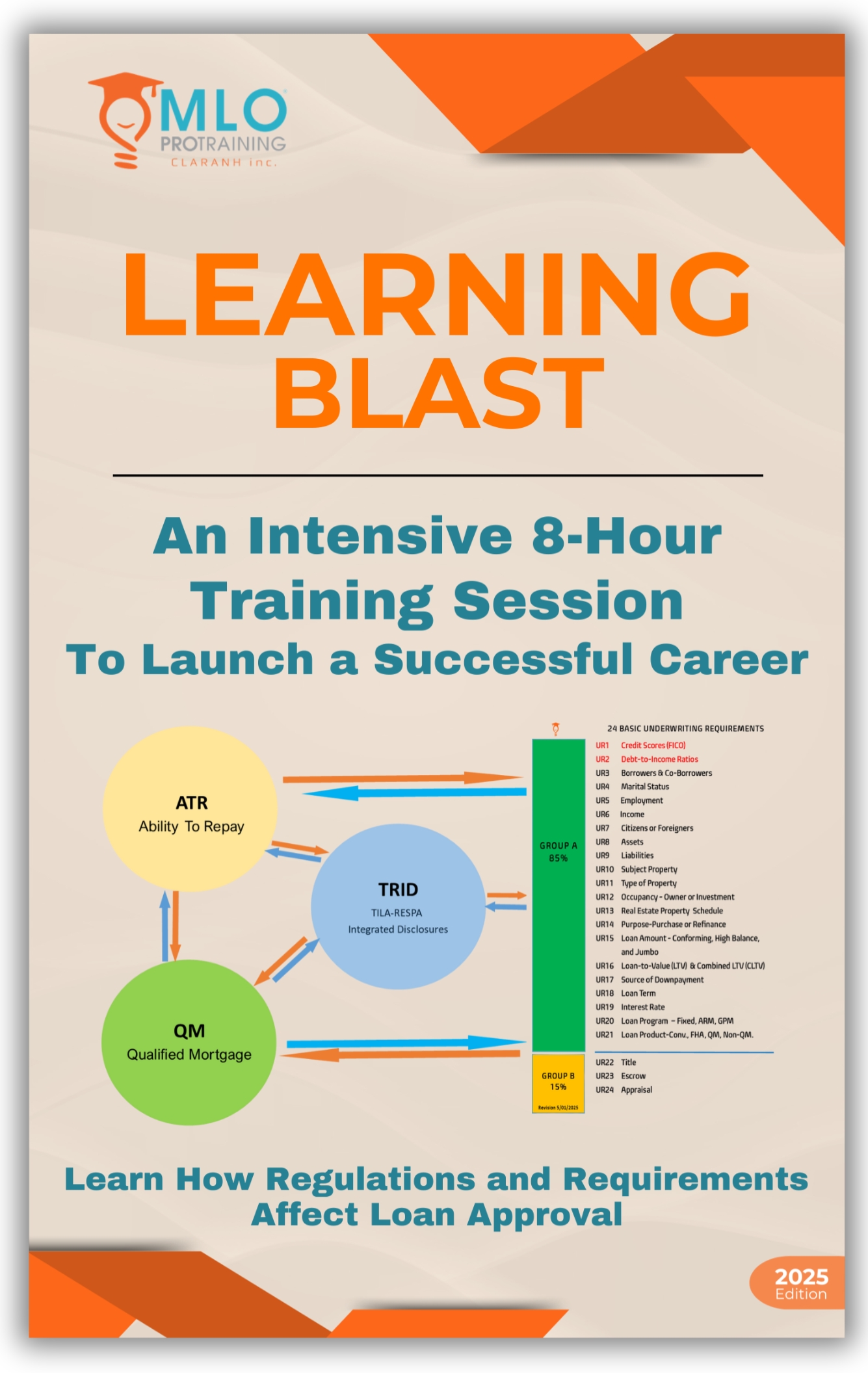

Explore Our Courses

Your Path to Success

Address

22792 Center Drive, Ste. 115

Lake Forest, CA 92630

support@mloprotraining.com

Phone

Follow Us

DISCLAIMER: MLO ProTraining is exclusively designed for NMLS-licensed loan originators. It offers a unique opportunity to bridge the gap between textbook knowledge and practical application through real-life scenarios. By completing your selected training courses, you will earn a Certificate of Completion that showcases your commitment to professional development. It's important to note that this training does not interpret current lending regulations or represent the lending policies of any specific lenders. However, it empowers you with the skills & insights necessary to excel in your role.