Invest In You & Change Your Future

Busy Moms Welcome

Join the thousands of busy working moms who enjoy this flexible, high-income career, whether you decide on a full-time or part-time career.

For Active or Experienced Loan Originators

Acquire the valuable skills that allow you to manage your business from start to finish, reducing the risk of loan fallouts.

A High-Demand Skill Always In Need

Be the one the mortgage industry calls to fill their need to experienced loan processors.

LOAN PROCESSOR

TRAINING

Live Classroom & Live Webinar

$5,625

The Value of Our Loan Processor Training

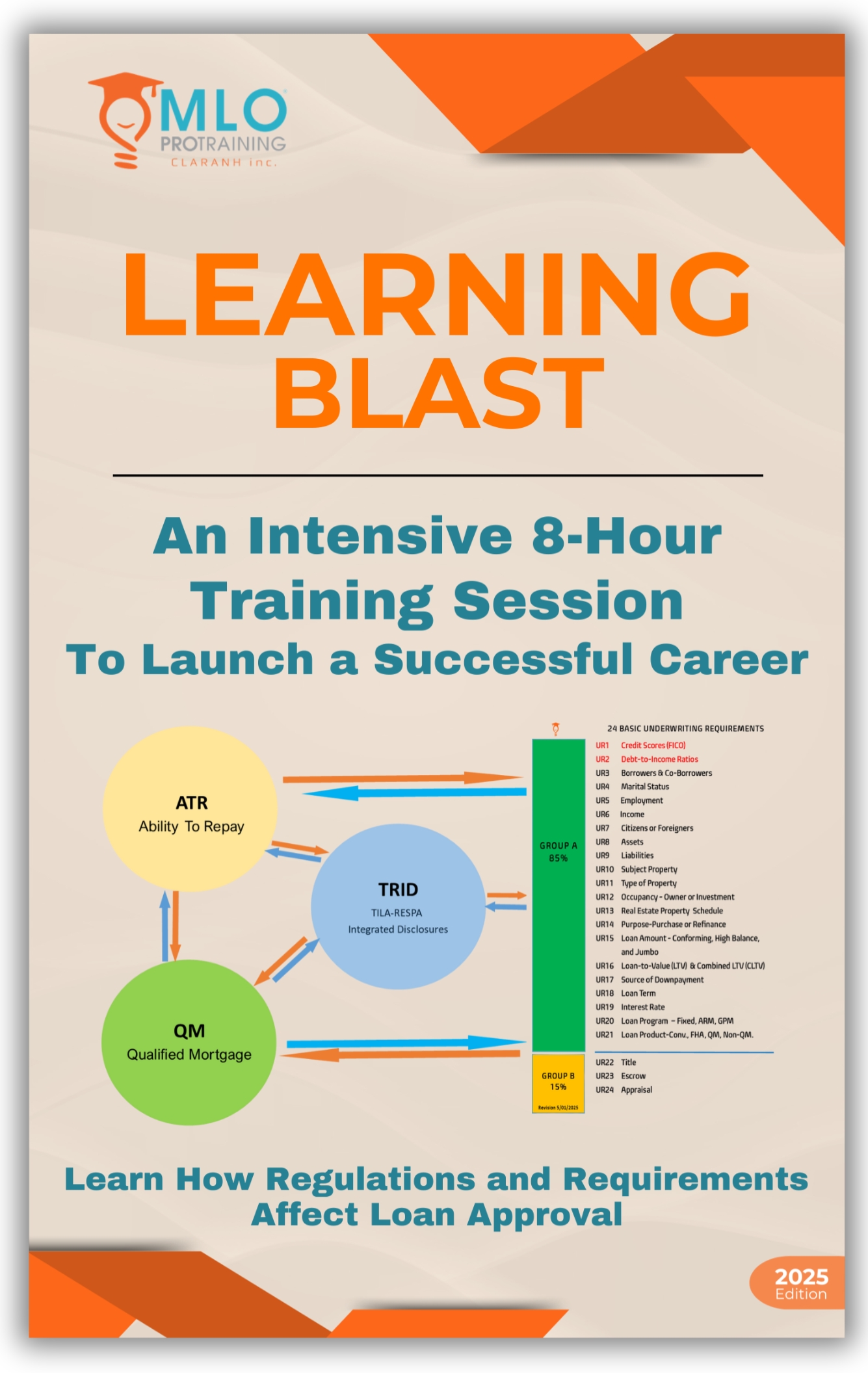

Our Loan Processor Training goes beyond traditional education. Unlike standard textbooks, our expertly designed training materials give you a practical, in-depth understanding of how to successfully package loan applications for underwriting approval.

This program emphasizes the critical role processors play in the mortgage process, highlights the common mistakes that can jeopardize files, and empowers you with the skills to protect your career and achieve long-term success.

Class Dates & Details

- Class & Webinar Dates: Monday through Friday

- Class & Webinar Hours: 1:30PM - 5:30PM

- Live Class: Join us at our Southern California training center in Lake Forest, CA for an immersive, in-person class.

- Live Webinar: Experience training with an experienced instructor from the convenience of your home or office.

- Questions? Email us at support@mloprotraining.com

- Click HERE to view our Refund & Cancellation Policy

- Click HERE to view our Frequently Asked Questions (FAQ)

Gain a clear understanding of the processor’s role in the loan cycle and how to perform at the highest level of professionalism.

Develop the skills to assemble complete, well-structured files that move smoothly through underwriting without unnecessary delays.

Master the essentials of required documentation so every file you submit meets compliance and lending criteria.

Use proven checklists to simplify your workflow, reduce errors, and keep each stage of processing efficient and accurate.

Apply industry-proven quality control measures that safeguard file integrity, reduce risk, and ensure underwriting approval.

Family Financial Security

- Open New Doors of Opportunity with Huge Earning Potential

- Ensure the Stable Income You’ve Always Dreamed of For Your Family.

- Start Your Six-Figure Income Career Now!

RESERVE YOUR SEAT

Certificate of Completion

Upon successfully completing the Loan Processor Training, participants will receive an official Certificate of Completion from MLO ProTraining. This certificate recognizes your commitment to professional development and demonstrates that you’ve gained practical, real-world knowledge in mortgage loan origination, processing, and closing.

(Note: This is not a state license or industry accreditation, but a validation of your advanced training and skills.)

Refund & Cancellation Policy

By completing your registration, you acknowledge and agree that all enrollments are final. While we do not offer refunds, we understand that schedules can change. If you cancel within the permitted notice period, we’ll issue you a credit to attend a future session of the same course type purchased. Credits cannot be applied to different courses and must be used within 12 months. No-shows forfeit all tuition/enrollment fees.

Explore Our Courses

Your Path to Success

Address

22792 Center Drive, Ste. 115

Lake Forest, CA 92630

support@mloprotraining.com

Phone

Follow Us

DISCLAIMER: MLO ProTraining is exclusively designed for NMLS-licensed loan originators. It offers a unique opportunity to bridge the gap between textbook knowledge and practical application through real-life scenarios. By completing your selected training courses, you will earn a Certificate of Completion that showcases your commitment to professional development. It's important to note that this training does not interpret current lending regulations or represent the lending policies of any specific lenders. However, it empowers you with the skills & insights necessary to excel in your role.