Description

Course Content

Live Classroom & Live Webinar

Signature ProTraining Series

The Signature Training Series is an advanced, results-driven program designed for loan originators who want to move beyond the basics and master the critical skills that directly influence loan approvals and successful closings. This training series focuses on high-impact areas where expertise can make the difference between a funded loan and a lost deal.

Through this series, you will:

- Strengthen your ability to package flawless files that sail through underwriting.

- Minimize risks of loan fallout by addressing critical compliance and documentation issues.

- Elevate your industry expertise to gain the trust of clients, agents, and lenders.

- Increase your closing ratio and secure long-term referral business.

Each module is structured to provide actionable strategies, real-world insights, and proven techniques that top-performing originators rely on to close more loans with confidence.

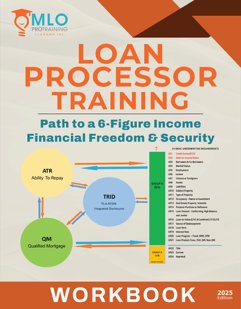

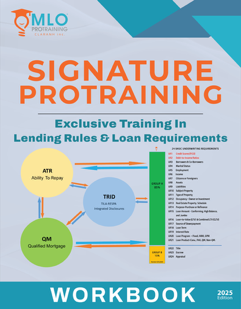

Signature Series 1

Compliance with QM, ATR & TRID Regulations

Deepen your understanding of Qualified Mortgage (QM) rules, Ability to Repay (ATR) requirements, and TILA-RESPA Integrated Disclosure (TRID) regulations. Learn how these regulations affect loan structuring, funding, and closing—and how to stay ahead of compliance pitfalls.

- Identify compliance risks before they jeopardize funding.

- Implement best practices to ensure every loan meets regulatory standards.

- Protect your pipeline from denials caused by compliance oversights.

Signature Series 2

Mastering the URLA: Error-Free Loan Applications

Errors on the Uniform Residential Loan Application (URLA) can create costly delays—or outright denials. This session focuses on the techniques needed to complete URLA forms with accuracy and precision.

- Learn to spot and correct common application errors.

- Understand how to align documentation with lender expectations.

- Submit applications that meet approval standards the first time.

Signature Series 3

Effective Borrower Pre-Approval

Proper pre-approval sets the stage for a successful transaction. In this session, you’ll learn how to conduct thorough and accurate borrower evaluations that reduce fallout risk.

- Ensure pre-approvals withstand underwriting scrutiny.

- Spot weak points early and take corrective action.

- Build stronger relationships with clients and real estate agents by delivering reliable pre-approvals.

Signature Series 4

The 24 Underwriting Requirements

Underwriting decisions hinge on 24 critical requirements that determine approval outcomes and interest rates. This session provides a detailed breakdown of each requirement, giving you the insight to structure stronger files.

- Learn how underwriters evaluate risk at every level.

- Anticipate and meet underwriting conditions proactively.

- Optimize loan structures for better approval outcomes.

Signature Series 5

Maximizing Loan Point Advantages

Loan points can be a powerful tool to solve cash shortages and improve funding outcomes—but only if used strategically. This session teaches you how to leverage points to maximize benefits for both you and your clients.

- Understand when and how to use points effectively.

- Solve funding challenges with creative structuring.

- Deliver value to clients while protecting your commission.

Signature Series 6

Identifying Issues in Title, Escrow, and Appraisal

Problems in title, escrow, or appraisal can derail closings if caught too late. Learn to identify these issues early, address them effectively, and keep your transactions on track.

- Recognize early warning signs in title, escrow, and appraisal reports.

- Resolve issues before they escalate into closing delays or denials.

- Keep your pipeline moving by proactively managing these critical components.

With the Signature ProTraining Series, you’ll gain the advanced skills, strategic insight, and confidence to consistently close more loans, protect your pipeline, and position yourself as a trusted expert in the mortgage industry.

Class Dates & Details

- Class & Webinar Dates: Monday through Friday

- Class & Webinar Hours: 1:30PM – 5:30PM

- Live Class: Join us at our Southern California training center in Lake Forest, CA for an immersive, in-person class.

- Live Webinar: Experience training with an experienced instructor from the convenience of your home or office.

Step Into Your Excellence!

- Earn Back Your Investment with Just One Closed Loan

- Make a Minimal Initial Investment to Spark Your Financial Growth

- Don’t Learn the Hard & Expensive Way from Lost Opportunities

- Don’t Stay on the Sidelines While Others Profit

- Get Trained & Ready Now!

Reviews

There are no reviews yet.