LEARNING BLAST

Learning Blast Live Class

December 3rd & 4th

1:30PM - 5:30PM PST

(25-12BlastClass)

$3,375

Live Class

Course Content

Live Class

Blast Training Series

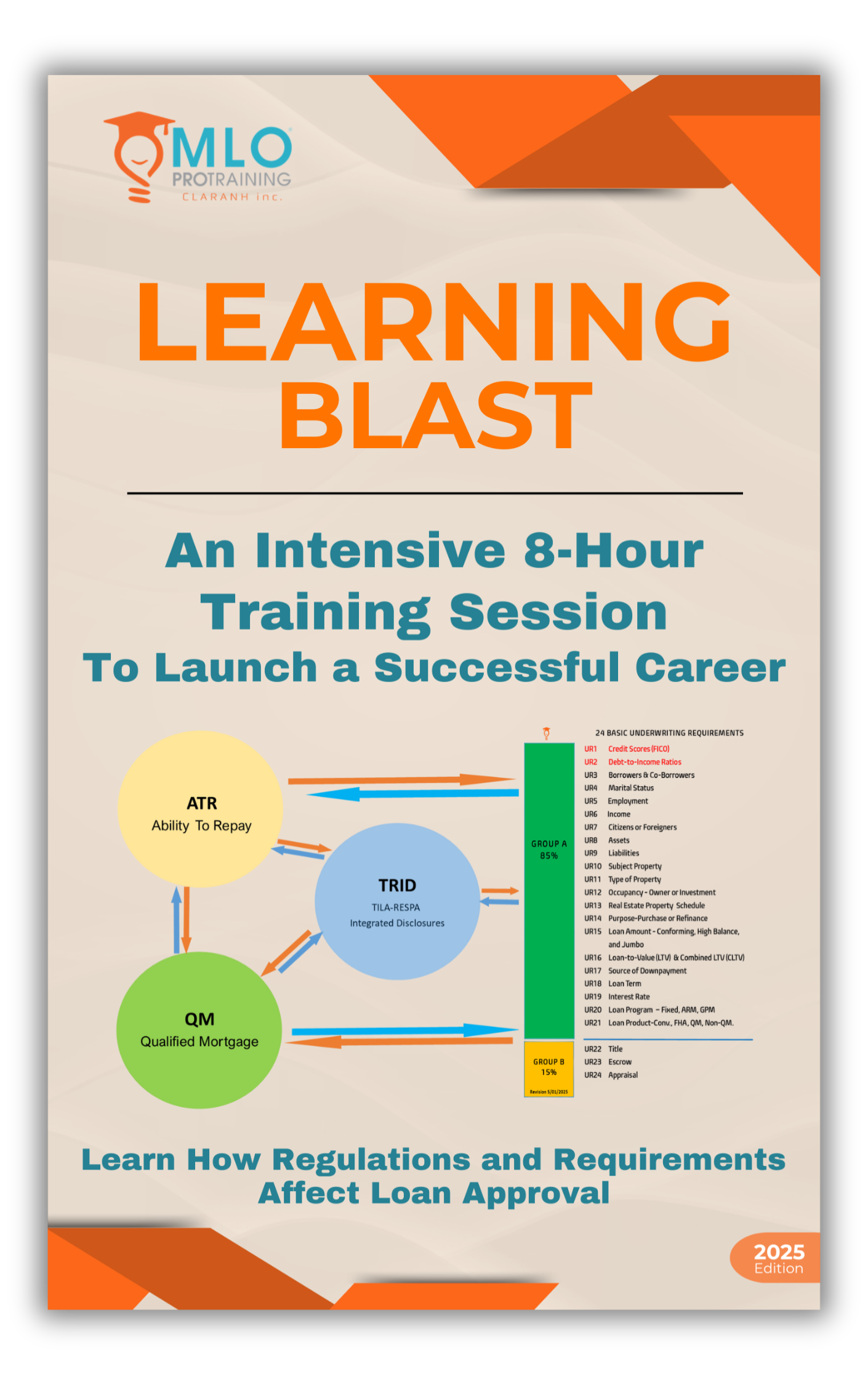

Through this series, you will gain:

-

A strong understanding of lending regulations and compliance requirements.

-

The ability to confidently pre-approve borrowers and identify potential risks early.

-

The skills to prepare accurate, compliant loan files ready for underwriting.

Each session is step-by-step, practically focused, and aligned with industry standards to ensure you are not only learning but also applying what you learn immediately to real scenarios.

Learn how compliance impacts loan approvals.

-

Identify regulatory pitfalls that can cause denials.

-

Build a compliance mindset from day one.

Pre-approval sets the tone for the entire transaction. In this session, you’ll learn how to evaluate borrower qualifications and conduct pre-approvals that stand up under underwriting review.

Understand what underwriters look for during pre-approval.

-

Learn to spot potential red flags before they become problems.

-

Gain strategies for managing client expectations while strengthening relationships.

The loan application is the foundation of every file—and mistakes here can cost approvals. This session teaches you to accurately complete and package the Uniform Residential Loan Application (URLA) for underwriting.

Learn proper documentation and data entry techniques.

-

Understand how to avoid errors that trigger conditions or denials.

-

Ensure every file you submit meets compliance and approval standards.

With the Learning Blast Training Series, you’ll leave equipped with the knowledge, processes, and confidence to originate loans efficiently, avoid costly mistakes, and build a successful career in the mortgage industry.

Class Dates & Details

- Class & Webinar Dates: Wednesday & Thursday

- Class & Webinar Hours: 1:30PM - 5:30PM

- Live Class: Join us at our Southern California training center in Lake Forest, CA for an immersive, in-person class.

- Live Webinar: Experience training with an experienced instructor from the convenience of your home or office.

- Questions? Email us at support@mloprotraining.com

- Click HERE to view our Refund & Cancellation Policy

- Click HERE to view our Frequently Asked Questions (FAQ)

Launch Your Success Now!

- Take Complete Control of Your Success by Learning the Essentials of Loan Funding

- Gain the Essential Tools and Techniques to Prevent Loan Fallouts

- Know How a Loan Package is Processed from Start to Finish

- Sign Up Now to Transform Your Investment into a Six-Figure Income!